Following a strong start to 2021 in January, new light-vehicle sales fell slightly in February to a SAAR of 15.7 million units. Sales were hampered by severe weather throughout much of the country that caused prolonged power outages, temporary production stoppages at auto plants and some dealership closures. Tight inventory levels caused by strong retail demand in recent months, coupled with impacts from the current global microchip shortage, also impacted sales in February as raw sales volume in February totaled 1.18 million units—down 12.6% from February 2020. But after adjusting for two fewer selling days this February than in last February, raw sales volume was only down by a little over 5%. Following the trends seen in recent months and after adjusting for selling days, preliminary estimates for February show year-over-year retail sales gains of 3% and fleet sales declines of 29%, according to Wards Intelligence.

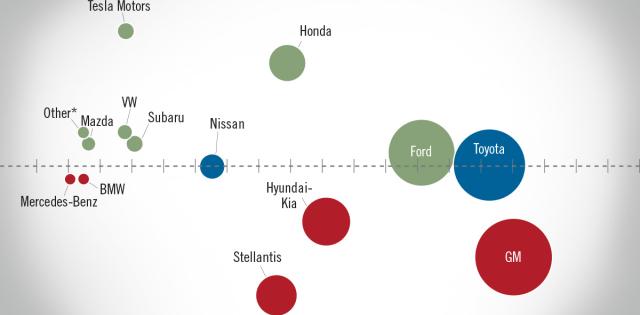

The global semiconductor microchip shortage is expected to cause North American production losses of around 250,000 units in first quarter 2021, with further losses expected in Q2. Nearly all OEMs have already been affected to some extent by the chip shortage. Many OEMs have canceled shifts at manufacturing plants across the globe, putting further pressure on already-lean inventory. We expect the microchip shortages to be resolved by Q3, and there is hope that the production losses suffered in the first half of 2021 can be made up later in the year.

Tight inventory levels have led to vehicles selling quickly once they hit dealership lots. According to J.D. Power, the average number of days a vehicle sat on the lot was 53, down 18 days from February 2020. Given the tight inventory environment and following trends seen in recent months, manufacturers have offered lower discounts than in previous years. Average incentive spending per unit, according to J.D. Power, is expected to be $3,562—down $614 from February 2020.

Despite the chip shortage headwinds, we are very optimistic about new-vehicle sales in 2021. We expect continued steady retail demand and improving fleet demand growth throughout the rest of the year. The recent announcements of a third COVID-19 vaccine and an improved timetable for vaccine doses to become widely available make us more optimistic about a return to normal and a solid year for vehicle sales.